Power Of Attorney Form Sars | Download and use any of these power of attorney letters for free. Power of attorney and declaration of representative. The power of attorney form shall be valid until superseded, revoked or by the death of the taxpayer(s) or representative(s). Us legal forms provides professionally drafted power of attorney forms for every state. These forms must be presented within its validity period, which could be anything between one month and 24 months, containing the required information and duly signed.

After the form is written, it's required to be signed in accordance with state law (usually a notary or two (2) witnesses. However, if a power of attorney grants somebody the right to engage in transactions relating to real estate, it may be necessary to record the form in order for it to be effective. These forms must be presented within its validity period, which could be anything between one month and 24 months, containing the required information and duly signed. This gives you more control over what happens to you if you have an accident or an illness and cannot. Ordinarily, power of attorney forms do not have to be registered with the state.

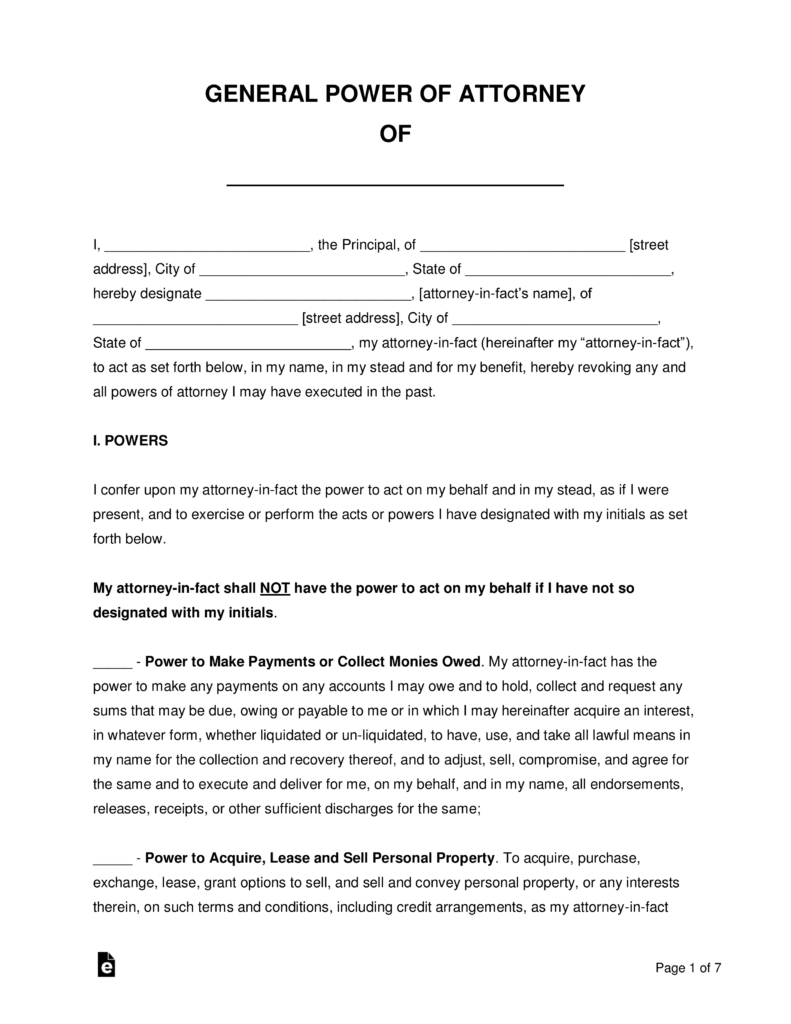

Us legal forms provides professionally drafted power of attorney forms for every state. The power of attorney revocation form is a document that lets a person put an end to an earlier delegated power. Power of attorney (poa) is a designation created by a person (principal) and given to someone else (agent) to make financial and medical decisions on their behalf. However, if a power of attorney grants somebody the right to engage in transactions relating to real estate, it may be necessary to record the form in order for it to be effective. Part i power of attorney. This is what we are going to focus on in this article. A principal can give an agent broad the power of attorney is frequently used in the event of a principal's illness or disability, or in legal transactions where the principal cannot be present. A specific power of attorney form limits your representative's responsibilities to certain types of decisions. Power of attorney forms presented to the sars branches should be original documents, with the exception of overseas taxpayers. A lasting power of attorney (lpa) is a legal document that lets you (the 'donor') appoint one or more people (known as 'attorneys') to help you make decisions or to make decisions on your behalf. Power of attorney is the document that enables people to authorize a person to the handle the affairs of the business, property, legal and limited power of attorney is the authorization form for money matters in professional fields. Sars power of attorney grants authority to a representative taxpayer or tax practitioner to act on behalf of a taxpayer. Power of attorney form enables an individual to nominate and provide legal authority to another person to act on various affairs.

A specific power of attorney form limits your representative's responsibilities to certain types of decisions. All you have to do is download it or send it via email. While other browsers and viewers may open these files, they may not function as intended unless you download and install. If the power of attorney form does not include all the information as instructed it will not be accepted. Power of attorney act 1882, power of attorney includes any instrument empowering a specified person to act for and in the name of the person executing it.

A power of attorney form (poa) is a document that lets a person (the principal) choose someone else (their agent) to handle their medical and financial responsibilities. You can always execute another power of attorney form if you still need your agent to continue acting on your behalf. Part i power of attorney. After the form is written, it's required to be signed in accordance with state law (usually a notary or two (2) witnesses. • power of attorney (poa) authority does not apply to custodial accounts unless you are an investment advisor acting in the capacity of a limited by signing this power of attorney form, i acknowledge that i have received and read the attached schwab power of attorney authorization. A power of attorney form is required to be. A specific power of attorney form limits your representative's responsibilities to certain types of decisions. You can choose to allow someone to only make decisions in relation to business, for example. Power of attorney format is a document made by an owner, he grants his legal authority to an agent. Tax information can be disclosed to the appropriate party. Sars power of attorney is valid for a maximum of 24 months. If you have, then it is a good thing, but if you have not done it yet, then you are at mistake. However, if a power of attorney grants somebody the right to engage in transactions relating to real estate, it may be necessary to record the form in order for it to be effective.

A power of attorney form is required to be. An ordinary power of attorney is only valid while you, the principal, are capable. You can choose to allow someone to only make decisions in relation to business, for example. While other browsers and viewers may open these files, they may not function as intended unless you download and install. A special power of attorney is a written document wherein one person (the principal) appoints and confers authority to another (the agent) to perform acts on behalf of the principal for one or more specific transactions.

Sars power of attorney is valid for a maximum of 24 months. An ordinary power of attorney is only valid while you, the principal, are capable. Various power of attorney form: The power of attorney form shall be valid until superseded, revoked or by the death of the taxpayer(s) or representative(s). A special power of attorney is a written document wherein one person (the principal) appoints and confers authority to another (the agent) to perform acts on behalf of the principal for one or more specific transactions. Once signed, this form straight away terminates the rights and responsibilities which were handed to a third party in the original power of attorney document. Ordinarily, power of attorney forms do not have to be registered with the state. Have you designated your power of attorney to your agent? A principal can give an agent broad the power of attorney is frequently used in the event of a principal's illness or disability, or in legal transactions where the principal cannot be present. Nowadays, it is quite easy to obtain a power of attorney letter. ▶ go to www.irs.gov/form2848 for instructions and the latest information. Power of attorney (poa) is a designation created by a person (principal) and given to someone else (agent) to make financial and medical decisions on their behalf. Power of attorney act 1882, power of attorney includes any instrument empowering a specified person to act for and in the name of the person executing it.

Power Of Attorney Form Sars: Power of attorney form enables an individual to nominate and provide legal authority to another person to act on various affairs.